Fair value needed for convertible notes?

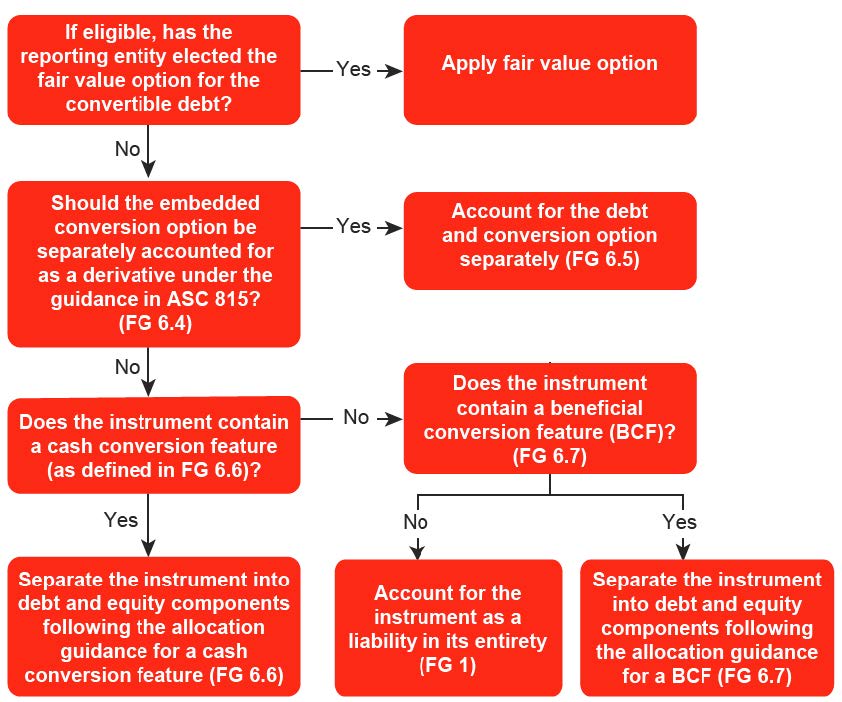

The accounting treatment for a convertible debt instrument depends on the terms of the instrument. Some convertible debt instruments are settled upon conversion entirely in shares, some in a combination of cash and shares, and, less commonly, entirely in cash. The terms of the convertible debt instrument may mandate a settlement method or the reporting entity may have a choice.

Many convertible debt instruments contain a number of provisions, such as put and call options or contingent interest features, which should be assessed to determine whether the features should be accounted for separately.

The below framework will help a reporting entity determine which of the four accounting models it should follow when accounting for its convertible debt.

The embedded features that must be bifurcated from the underlying debt host for accounting purposes may be subject to fair value measurement and mark-to-market adjustments each period, impacting reported earnings and requiring valuation experts to determine the valuation of such instrument.

ASC 815-15-25-1 requires that an embedded feature be evaluated for the following three criteria to determine if bifurcation and derivative treatment are appropriate:

1. The economic characteristics and risks of the embedded derivative are not clearly and closely related to the economic characteristics and risks of the host contract.

2. The hybrid instrument is not remeasured at fair value under otherwise applicable generally accepted accounting principles (GAAP) with changes in fair value reported in earnings as they occur.

3. A separate instrument with the same terms as the embedded derivative would be classified as a derivative instrument subject to derivative accounting pursuant to Section 815-10-15. For an embedded feature to qualify as an embedded derivative, it must first qualify as a derivative when evaluated as a freestanding instrument and not an embedded feature. To qualify as a derivative, the following three criteria must be met:

a) The feature must have an underlying and a notional and/or payment provision.

b) There must be no initial investment, with the exception of an investment that is less than the expected market value of the feature. (The initial net investment for the hybrid instrument shall not be considered to be the initial net investment for the embedded derivative).

c) The contract must allow for net settlement or provide a way to achieve the equivalent of net settlement (i.e. the use of a market mechanism or the delivery of an asset readily convertible to cash).

If the qualifications are not met, there is no need to bifurcate and separately account for the feature, and the debt should be recorded based either on the cash proceeds received, or on the allocated proceeds.

Beneficial conversion feature (BCF) on a convertible note

When the conversion price of a convertible instrument is below the fair value of the shares of the underlying stock, a beneficial conversion feature (BCF) exists. Determine whether the conversion feature is in the money at the commitment date. If the feature is in the money, there is a beneficial conversion and it will be necessary to “allocate the debt proceeds with an equity component receiving the intrinsic value of the beneficial conversion feature.”

An issuer’s beneficial conversion feature on a convertible instrument is equal to the difference between the company’s market price of common stock on the measurement date and the effective conversion price multiplied by the number of shares the holder is entitled to upon conversion.

If BCF is a contingent beneficial conversion upon the success of IPO, BCF would be recorded at the date of conversion. On the issuance of the convertible note, BCF is accounted as a liability in its entirety of the convertible note.

How to get help?

HG, LLP specializes in accounting and valuation for convertible debts. We’ll help you understand the basics of convertible debts and other complex securities such as warrants. Please contact us through www.hg-llp.com and make an appointment as below.